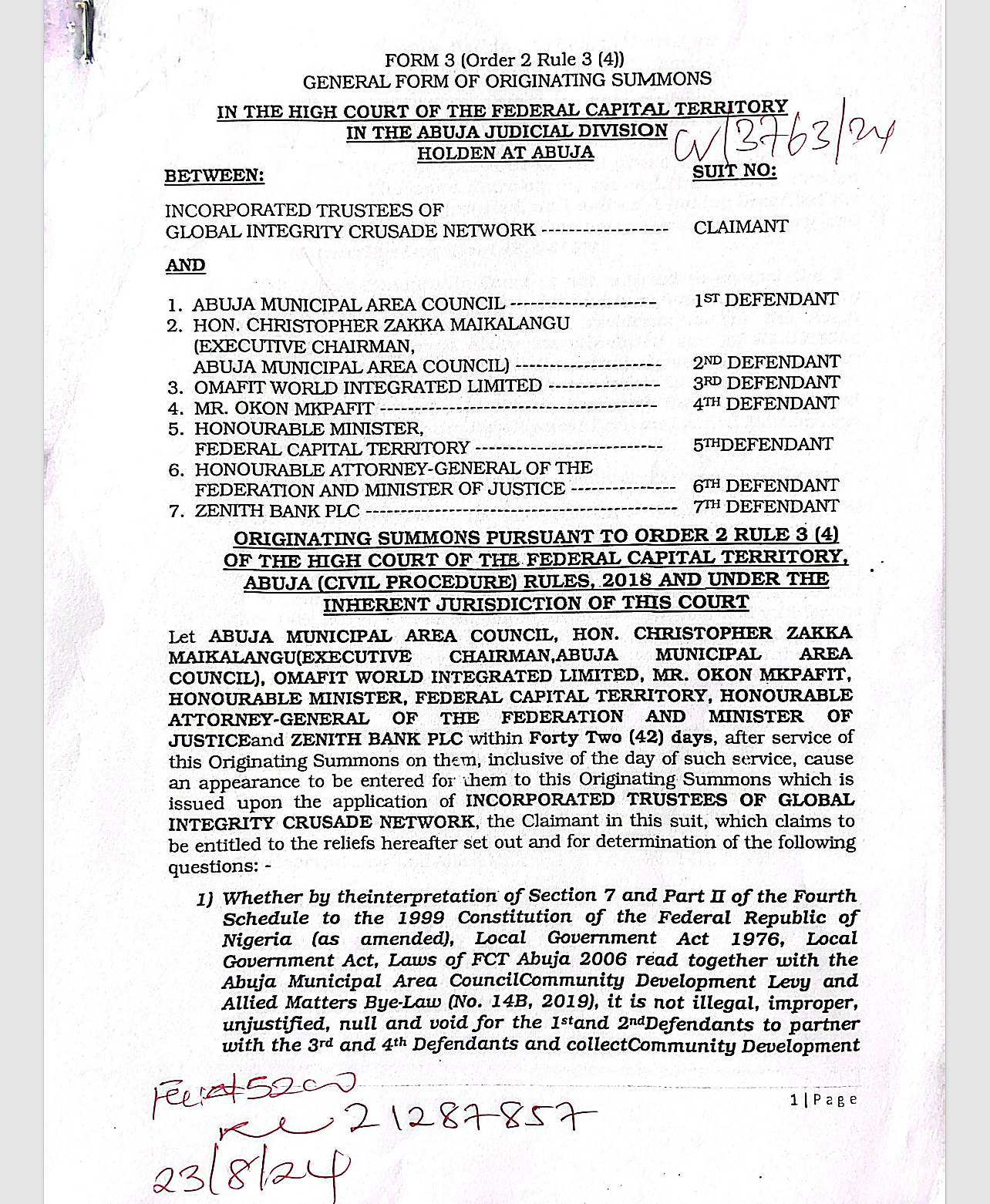

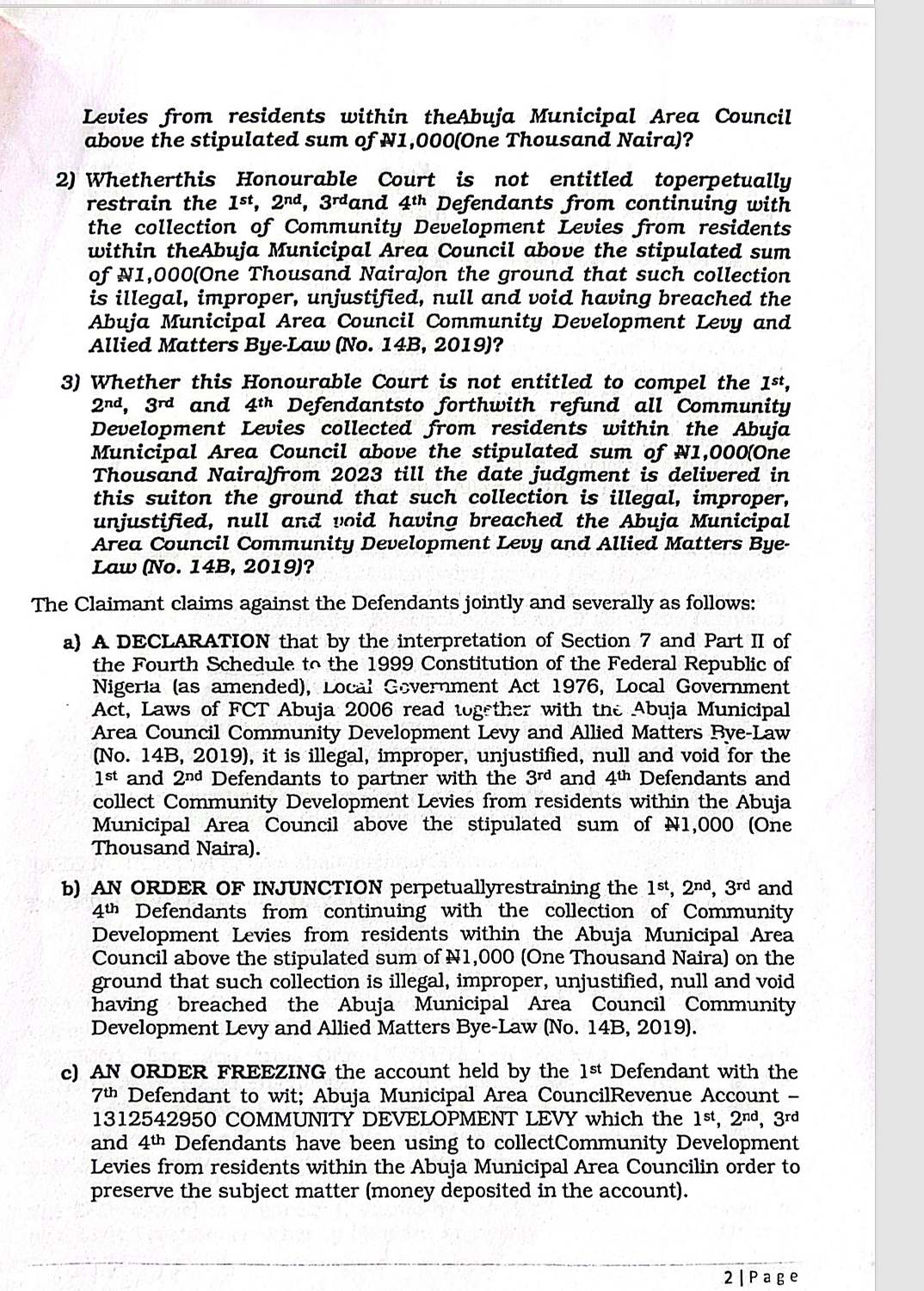

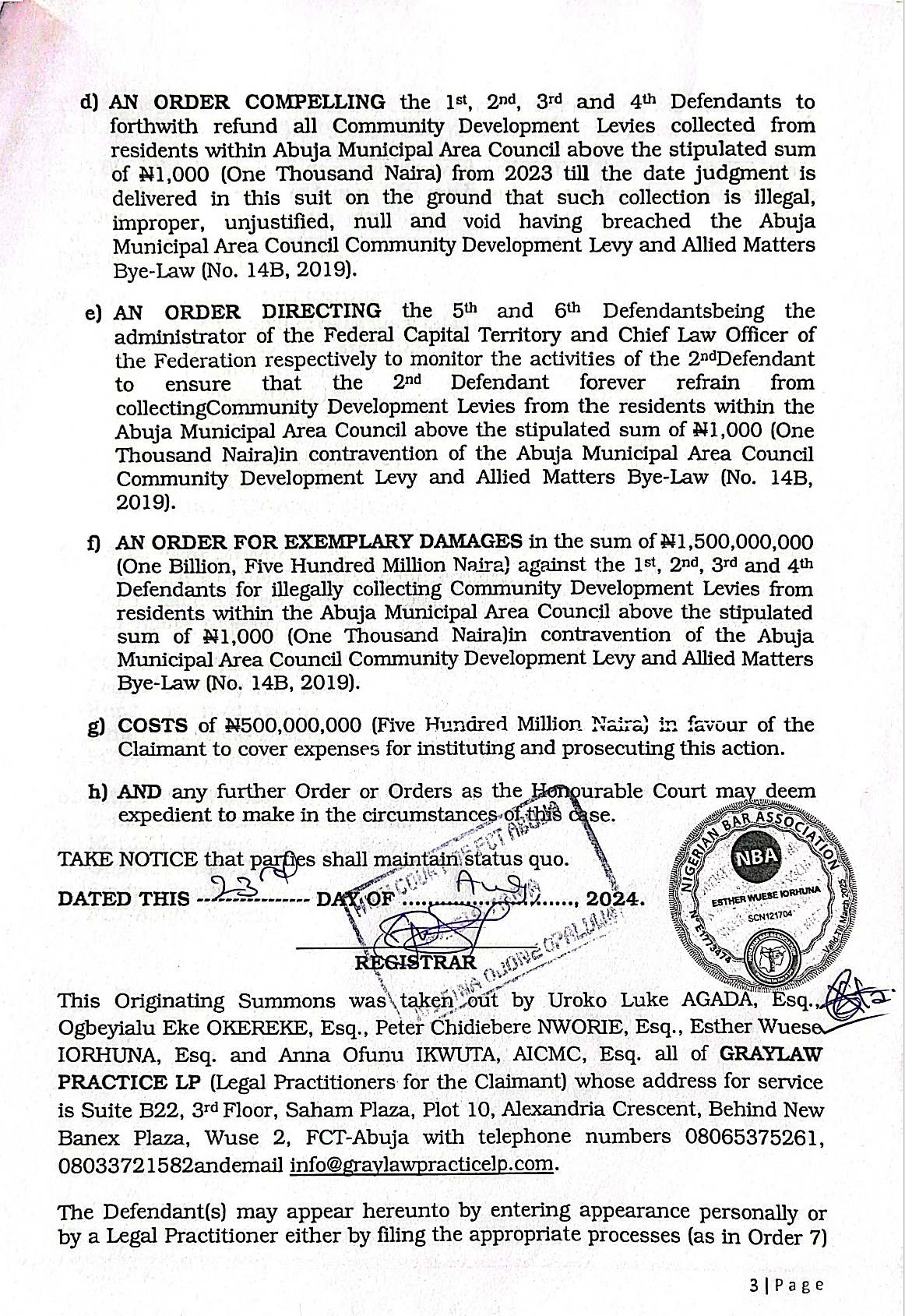

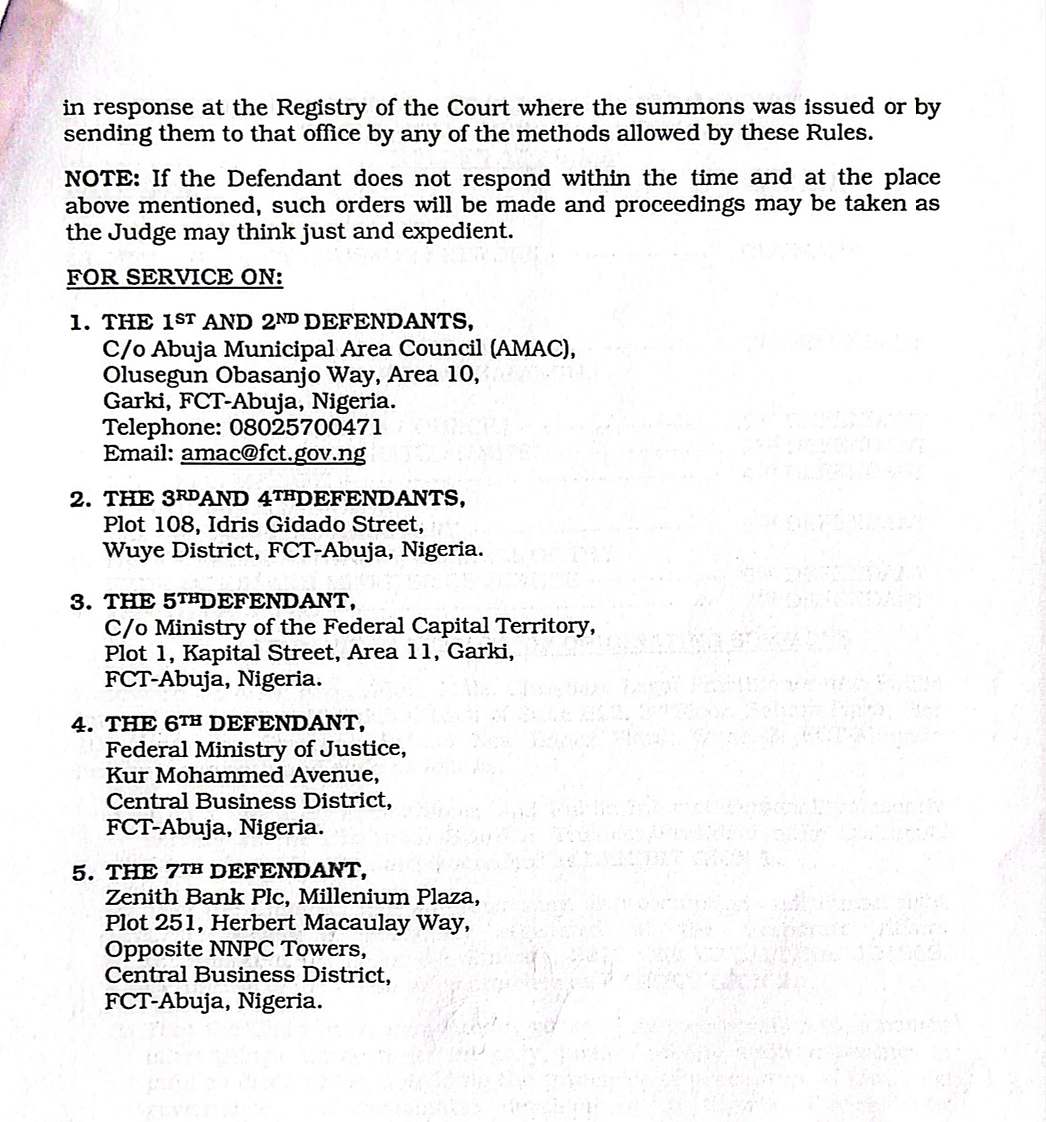

Sometimes in 2024, Global Integrity Crusade Network, a civil society organization, dragged Abuja Municipal Area Council, its chairman, Hon Christopher Zakka Malkalangu and others to court over illegal and unlawful collections of Community Development Levies from Abuja residents.A review of the AMAC Bye-Law and its schedule reveals that the approved sum for collection is pegged at One Thousand Naira both for individual and corporate bodies.In the originating summons, the group queried the legality of the Demand Notice issued to the residents of Abuja through one of their technical partners, Omafit World Integrated Limited, a company owned by one Okon Mkpafit demanding for various sums of money ranging from N40,000 N5,000,000 toN70,000,000 as Community Development Levy contrary to the clear provisions of the AMAC Bye-Law (No. 14B)2019, which stipulate the payment of N1,000. for both corporate bodies and individuals. Initially the Council’s Chairman, Hon. Christopher Zakka Malkalangu had denied the collection of Community Development Levy in a media chat on d 21st of August say “We don’t Collect Revenue on Community Development Levy” this denial was in widely publicized.

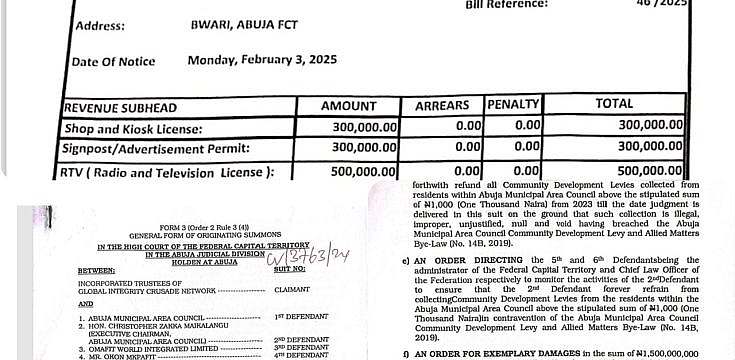

However, while the matter is still pending before the FCT High Court, another sets of demand notices has resurfaced in January,2025, through same technical partner served on companies, multinational companies and residents making demands of several millions ranging from #5,000,000 and above, this time around citing a non-existent AMAC (Bye-law No. 31) 2024. One would have thought that with the case before Hon Justice N.C Nwabulu, of FCT High Court 35, Kurudu, the council and his technical partner would have stayed collection of the said revenue pending the determination of the suit especially where there is defect in the Bye-Law that empowers them.

However, while the matter is still pending before the FCT High Court, another sets of demand notices has resurfaced in January,2025, through same technical partner served on companies, multinational companies and residents making demands of several millions ranging from #5,000,000 and above, this time around citing a non-existent AMAC (Bye-law No. 31) 2024. One would have thought that with the case before Hon Justice N.C Nwabulu, of FCT High Court 35, Kurudu, the council and his technical partner would have stayed collection of the said revenue pending the determination of the suit especially where there is defect in the Bye-Law that empowers them.

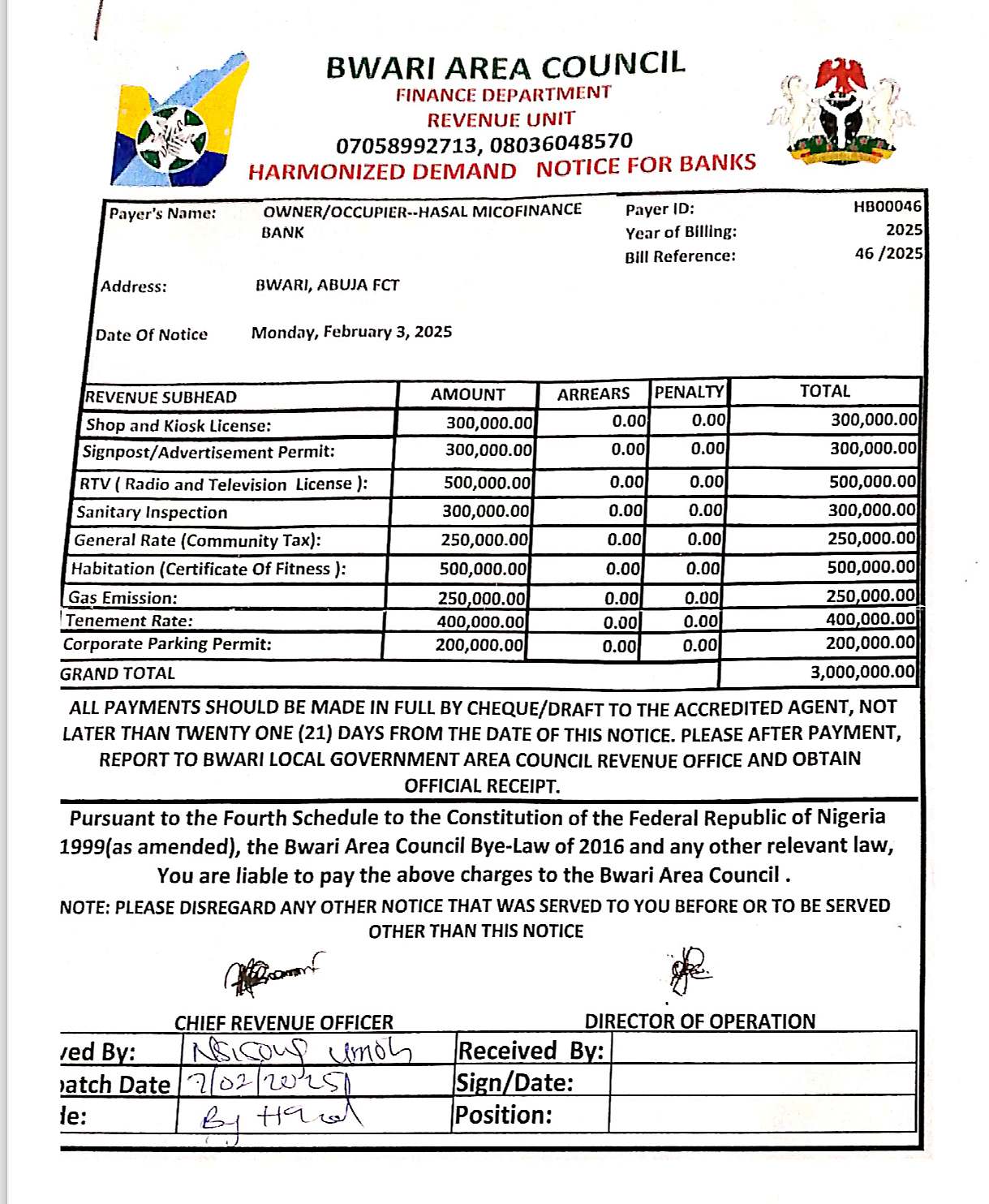

This amounts to extortion by the Area Council and and its technical partner, Omafit Global Integrated Services Limited own by Mr. Okon Mkpafit. Similarly, there is a backlash from the banks and other financial institutions within the Bwari Area council over the humongous and outrageous demand they received from the Bwari Area Council for 2025 tax year,For a branch of commercial bank, it is over 17m which is a clear departure from what was agreed and paid to the council in years ,2024. This is as a result of the Council decision to harmonized levies influenced by Mr. Okon Mkpafit of Omafit Integrated Ventures without recourse to whatever legal implications between the banks and other financial institutions and the council,thereby sidelining all other technical partners whom have on behalf of the council’s instructions early January2025, served the usual demand notices on the banks and other financial institutions( a case of first at hand) which was factored by the banks into their operational cost for the year 2025, as a matter of facts the banks have been said to have worked on the very first demand notices over a month ago only awaiting approval to effect payments from their respective head office, before another set of harmonized demand notices came just two(2) weeks ago in the month of February,2025;as we speak the banks have in their possession two(2) sets of demand notices from d same council for 2025 tax year.

This is as a result of the Council decision to harmonized levies influenced by Mr. Okon Mkpafit of Omafit Integrated Ventures without recourse to whatever legal implications between the banks and other financial institutions and the council,thereby sidelining all other technical partners whom have on behalf of the council’s instructions early January2025, served the usual demand notices on the banks and other financial institutions( a case of first at hand) which was factored by the banks into their operational cost for the year 2025, as a matter of facts the banks have been said to have worked on the very first demand notices over a month ago only awaiting approval to effect payments from their respective head office, before another set of harmonized demand notices came just two(2) weeks ago in the month of February,2025;as we speak the banks have in their possession two(2) sets of demand notices from d same council for 2025 tax year.

Even though the term ” Harmonization ” is alien to tax law non in the Bwari Area council byelaw,but it was said to have been used by the council for administrative convenience perhaps to convey the weighty bills without any prompt notice to the financial institutions, Under the new regime of harmonization of Taxes and levies by the Bwari Area Council, a branch of MicroFinance Bank on rentage pays as much N3,000,000 as against between N500,000 to N600,000 being paid in the year 2024 for all the revenue items to the council.

Under the new regime of harmonization of Taxes and levies by the Bwari Area Council, a branch of MicroFinance Bank on rentage pays as much N3,000,000 as against between N500,000 to N600,000 being paid in the year 2024 for all the revenue items to the council.

This new exclated increase is not supported by law as there is nothing in the Bwari Area Council’s Bye-law that empowers the council to unlawfully demand and collect such humongous amount.

In defence of Communal Values.