A storm is brewing in the Federal Capital Territory (FCT) as the Incorporated Trustees of the League for Social Justice drags two area councils, their chairmen, and several other defendants before the High Court of the FCT, alleging widespread extortion through illegal taxes, levies, and dues.

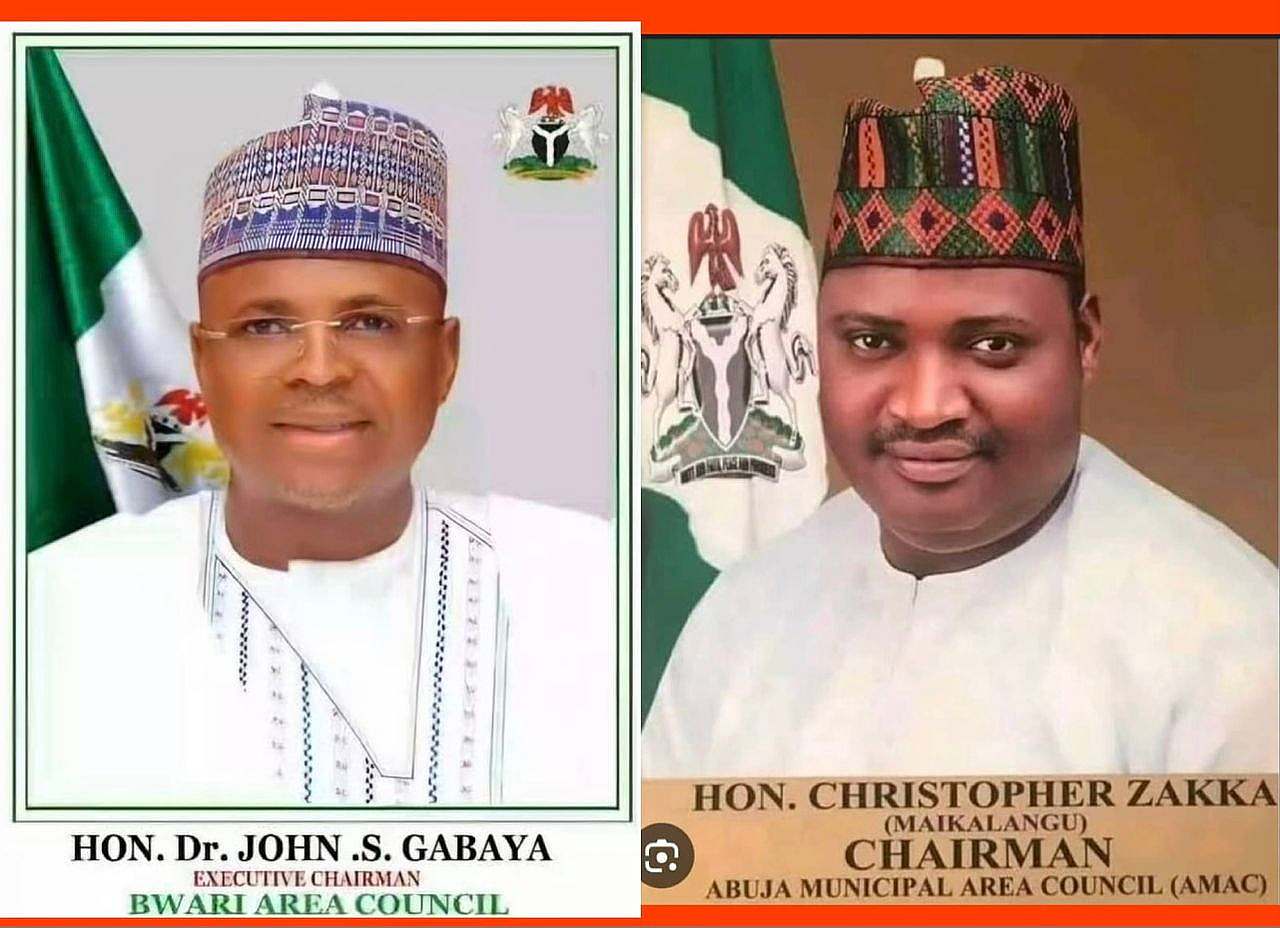

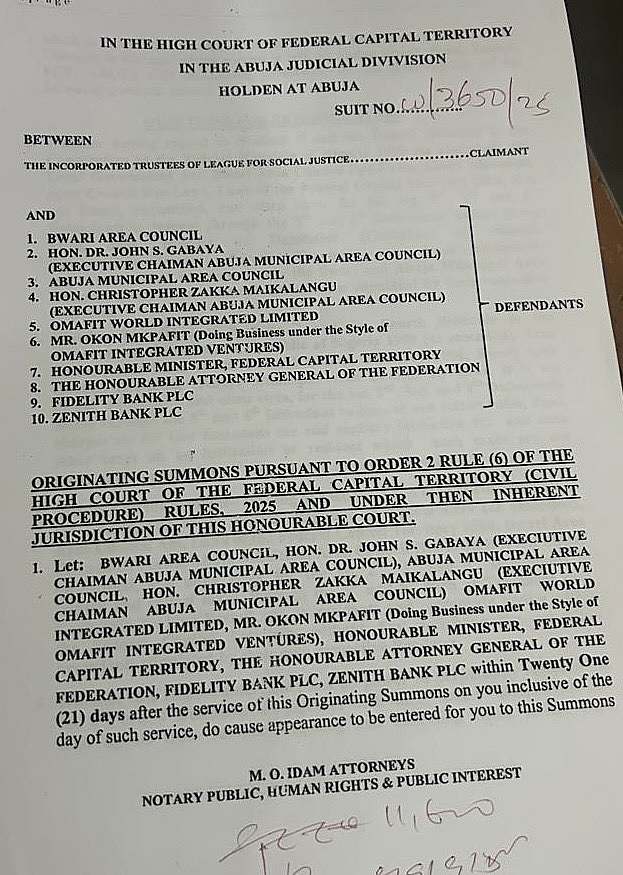

In the suit numbered FCT/3650/25, filed in the Abuja Judicial Division, the civic group accuses Bwari Area Council and Abuja Municipal Area Council (AMAC) of imposing charges far beyond what is allowed by law.  The case also ropes in their executive chairmen — Hon. Dr. John S. Gabaya of Bwari and Hon. Christopher Zakka Maikalangu of AMAC — alongside Omafit World Integrated Limited & Omafit integrated ventures both owned by a businessman Mr. Okon Mkpat, the Minister of the FCT, the Attorney General of the Federation, and two major banks — Fidelity Bank Plc and Zenith Bank Plc.

The case also ropes in their executive chairmen — Hon. Dr. John S. Gabaya of Bwari and Hon. Christopher Zakka Maikalangu of AMAC — alongside Omafit World Integrated Limited & Omafit integrated ventures both owned by a businessman Mr. Okon Mkpat, the Minister of the FCT, the Attorney General of the Federation, and two major banks — Fidelity Bank Plc and Zenith Bank Plc.

What’s at Stake?

The claimants, represented by M.O. Idam Attorneys (Notary Public, Human Rights & Public Interest), want the court to determine whether councils in the FCT have the legal right to demand payments such as:

Tenement rates, Certificates of habitation, Signpost/advertisement permits,

Corporate parking permits,

Gas emissions and sanitary inspection charges, and

Other levies not expressly provided for in council bye-laws.

The group insists that such collections are unconstitutional, illegal, and a direct violation of the 1999 Constitution, the Area Council Act, and the councils’ own bye-laws.

The Reliefs Sought.

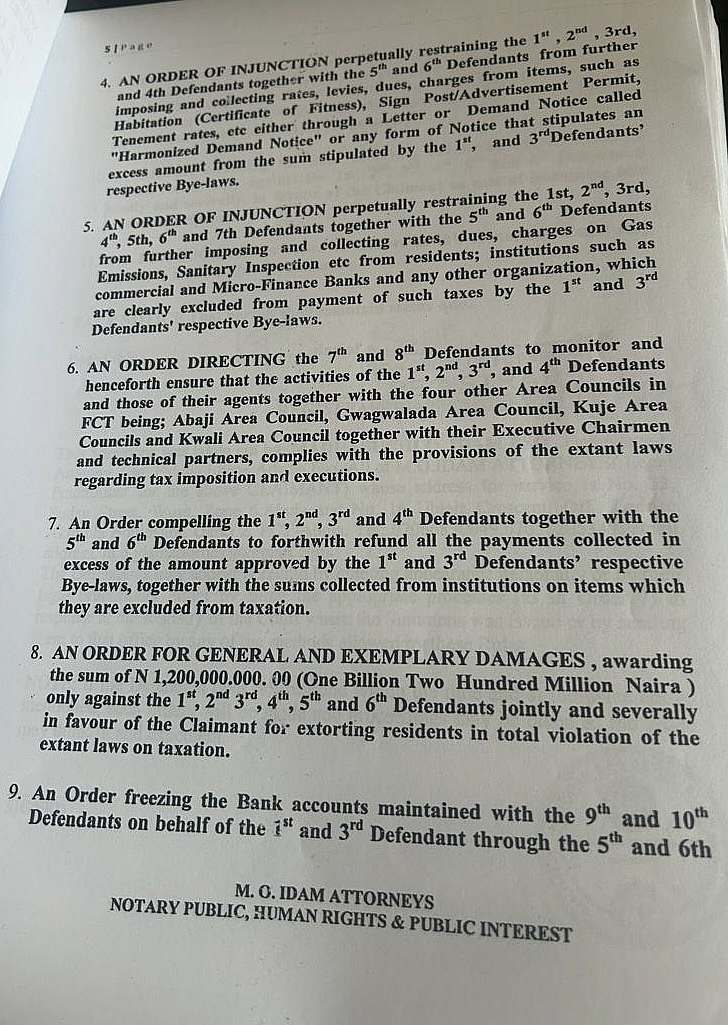

The League for Social Justice is asking the court for far-reaching orders, including:

A perpetual injunction stopping the councils, their chairmen, and agents from imposing or collecting the disputed levies.A refund of all excess payments collected from residents, businesses, and institutions.

₦1.2 billion in general and exemplary damages, jointly and severally against the councils, their chairmen, and private contractors acting as revenue agents or technical partners,

An order freezing bank accounts held with Fidelity and Zenith Bank to prevent further collections.

A monitoring directive compelling the FCT Minister and the Attorney General to ensure all six area councils comply strictly with extant taxation laws.

Why It Matters. The case touches the very nerve of governance in the FCT: the balance between raising revenue locally and protecting residents from arbitrary taxation. Businesses, banks, and even microfinance institutions have long complained of multiple levies and harassment by revenue agents across Abuja’s councils.

The case touches the very nerve of governance in the FCT: the balance between raising revenue locally and protecting residents from arbitrary taxation. Businesses, banks, and even microfinance institutions have long complained of multiple levies and harassment by revenue agents across Abuja’s councils.

If the court sides with the claimants, it could reshape how FCT councils generate revenue and set a precedent limiting the powers of local governments nationwide. On the other hand, a ruling in favour of the councils could embolden local authorities to continue or expand such collections.

The Road Ahead.

The High Court has ordered all defendants to enter appearance within 21 days of being served with the originating summons. Until then, Abuja’s residents and businesses — long weary of what they describe as “taxation by intimidation” — will be watching closely. For many, this case is more than just a lawsuit; it is a test of whether Nigeria’s courts can draw a firm line between lawful governance and what the claimants bluntly call “extortion in the name of taxation.”

For many, this case is more than just a lawsuit; it is a test of whether Nigeria’s courts can draw a firm line between lawful governance and what the claimants bluntly call “extortion in the name of taxation.”

In defence of Communal Values.